When starting a business in Singapore, knowing the different structures available and deciding on one that best fits your needs is important. You may want to consider things like the scale of your business, liability protection needs, start-up capital, compliance and growth plans. Professional legal advice can help you review and select the best option for your business goals and circumstances, providing you with the guidance and support you need. For more detailed information, reach out for a discussion with our experienced legal experts today.

Navigating Business Structures in Singapore

1. Sole Proprietorship

The first and simplest business structure is a sole proprietorship, a low-risk business owned by a single individual.

Key features:

- Can be set up by a Singaporean citizen, Singapore permanent resident, employment pass holder, dependent pass holder or foreigner (However, if the owner is a foreigner, it is mandatory to appoint a local manager who is a Singapore resident.)

- Not a separate legal entity from business owner

- Unlimited liability for business owner

- Relatively simple and low-cost registration and compliance requirements

- Challenging to secure funding from investors and bank loans.

- Taxed as personal income

2. Partnership

A partnership is akin to a sole-proprietorship business but consisting of 2 to 20 partners.

Key features:

- Can be set up by at least 2 individuals who are Singaporean citizens, Singapore permanent residents, employment pass holders, dependent pass holders or foreigners (must appoint local manager)

- Not a separate legal entity from business owner

- Partners have joint and several and unlimited liability

- Relatively simple and low-cost registration and compliance requirements

- Challenging to secure funding from investors and bank loans.

- Taxed as personal income

Taxed as personal income

3. Limited Partnership (LP)

A limited partnership is a business with at least 1 General Partner (GP) and 1 Limited Partner (LP), with unlimited number of partners.

Key features:

- Can be set up by any local or foreign individual or company.

- Mandatory to appoint a local manager if all GPs are based outside Singapore.

- Not a separate legal entity from business owner

- GPs have unlimited liability, LPs have limited liability

- Relatively simple and low-cost registration and compliance requirements

- Taxed as personal income except for corporate partners

4. Limited Liability Partnership (LLP)

A limited liability company is one where all partners have limited liability, with no limit on number of partners.

Key features:

- Can be set up by any local or foreign individual or company.

- Mandatory to appoint a local manager

- Operates as a separate legal entity from business owners

- Partners are not held personally liable for debts and losses incurred by the LLP

- Relatively simple registration and set-up in comparison to a company

- Taxed as personal income except for corporate partners

5. Local Company

Companies are the most common type of structure when doing business in Singapore. There are 3 main types of local companies:

Exempt Private Company – maximum of 20 shareholders in the business.

Private Company – not more than 50 shareholders in the business.

Public Company – more than 50 shareholders in the business, but not to be confused with a public listed company (where a company’s shares are listed on a stock exchange).

Key features:

- Can be set up by any local or foreign individual or company.

- Mandatory to have a local director, unless a foreigner applies for an EntrePass.

- Operates as a separate legal entity from shareholders.

- All shareholders have limited liability, up to the total amount they had invested into the company

- More complex and costly registration and compliance requirements

- Required to audit accounts and file annual returns with ACRA

- Easier to secure funding from investors and bank loans.

- More options for business and start-up grants available in Singapore.

- Taxed on corporate tax rates

- Enjoy (partial) tax exemption schemes for new companies that meet the requirements

When starting a business in Singapore, knowing the different structures available and deciding on one that best fits your needs is important. You may want to consider things like the scale of your business, liability protection needs, start-up capital, compliance and growth plans. Professional legal advice can help you review and select the best option for your business goals and circumstances, providing you with the guidance and support you need. For more detailed information, reach out for a discussion with our experienced legal experts today.

Disclaimer: The content of this article does not constitute legal advice and should not be relied on as such. Specific legal advice should be sought for your circumstances.

Navigating Divorce in Singapore: A Simplified Guide

Divorce is both an emotional and significant life event, often accompanied with many legal complexities. This article provides a simplified guide on how to get a divorce in Singapore. First, let us take a look at what makes someone eligible for divorce.

Eligibility Criteria for Divorce

Certain conditions must be met to apply to divorce.

Your or your spouse must:

- Have resided in Singapore for at least three years

- Have been married for at least three years. However, with permission, exceptions can be granted in cases of exceptional hardship or depravity.

If you are married under Syariah Law, you must file for divorce in the Syariah Court.

Grounds for Divorce

To be granted a divorce in Singapore, you will have to show irretrievable breakdown of your marriage. This can be established through one of the following:

1. Adultery: Your spouse has cheated on you, and you find it intolerable to continue living together.

2. Unreasonable Behaviour: Your spouse has behaved in a way that makes it unreasonable for you to live together. This includes abuse (physical or mental) or other forms of misconduct.

3. Desertion: Your spouse has deserted you for at least two years with no intention of returning.

4. Separation:

- With Consent: Both parties have lived apart for at least three years and agree to the divorce.

- Without Consent: Both parties have lived apart for at least four years.

5. Mutual Agreement: Both parties agree that their marriage has irretrievably broken down. This requires a written agreement stating the reasons for the breakup, efforts made to reconcile and a few other considerations.

Contested vs Uncontested Divorce

Will the divorce proceedings be contested by a party?

If both parties are agreeable to the divorce, parties may apply for uncontested divorce proceedings under the simplified track. Essentially this just means that the divorce process is faster and more straightforward compared to the normal track.

If a party contests to any part of the divorce, the divorce proceedings will have to be completed on the normal track.

Divorce is a 2-stage process:

1. Dissolution of Marriage:

- Filing for Divorce: Start out the process by submitting the necessary legal documents via the eLitigation platform. It is recommended to consult a lawyer to assist in preparing these documents.

- Serving of Documents: The Originating Application must be served to your spouse within 14 days of filing (in Singapore) or 28 days of filing (overseas).

- Interim Judgment: If the court is satisfied that the marriage has irretrievably broken down, it will issue an Interim Judgment while ancillary matters are being resolved.

2. Ancillary Matters:

The second stage of a contested divorce process deals with all other ancillary matters including the division of matrimonial assets, maintenance of spouse and child(ren), as well as access, care and custody of the child(ren).

- Child Care Arrangements: If you and your spouse have children, arrangements such as custody, care and access will have to be discussed prior to the divorce. These affect major decisions for the child, which parent they live with, how often each parent gets to see the child, and more.

- Asset Distribution: You and your spouse will have to decide on how assets such as your matrimonial house and joint bank account monies will be divided.

- Maintenance: Financial support such as alimony and child support will have to be assessed and discussed.

Divorce is a life-changing event that can take a toll emotionally and financially. Allow us to figure out the complexities of these proceedings while you focus on the emotional aspects of the process. Reach out to our professionals today for any questions or assistance on divorce in Singapore.

Disclaimer: The content of this article does not constitute legal advice and should not be relied on as such. Specific legal advice should be sought for your circumstances.

A Guide to Part-Time Employment in Singapore: Flexibility with Benefits

Part-time employment has been an increasingly popular option in Singapore, allowing for more flexibility while balancing other commitments. The perks don’t stop there! In fact, did you know part-timers are entitled to benefits like paid public holidays, annual leave, and more? Let’s dive into this month’s article to uncover key regulations and entitlements for part-time work in Singapore

What Is Considered Part-Time Work in Singapore?

According to the Employment Act, a part-time employee is one who is contracted to work less than 35 hours a week. Despite their shorter hours, part-time employees are protected by the same labour laws as full-time employees.

What Should Be in Your Part-Time Contract?

A Contract of Service should contain the following key specifications:

- Hourly rate of pay (with and without allowances)

- Number of working hours and days

- Pro-rated benefits and entitlements

Entitlements For Part-Time Employees

Now for the most exciting part, what are part-timers entitled to, and how do they work?

1. Leave entitlements

Although not commonly known, part-timers under Employment Act are qualified for paid annual leave, sick leave, and hospitalisation leave. If conditions are met, there may also be paid maternity, paternity, shared parental, childcare and adoption leave.

How to calculate Annual Leave (AL):

(Part-time working hours per year / Full-time working hours per year) x AL days for Full-time with equal length of service x Working hours in a day for Full-time

Example

Part-time: 20 hours /week

Full-time: 40 hours /week (8 hours /day)

Full-time AL: 14 days /year

((20×52) / (40×52)) x 14 x 8 = Part-timer is entitled to 56 hours of AL per year

Similarly, sick leave and hospitalisation leave are pro-rated in the same way and granted in hours instead of days.

2. Overtime Pay

Part-timers qualify for Overtime (OT) pay when they exceed their contractual working hours. How much you get paid depends on how your hours stack up against those of a full-timer in a similar role.

How it works:

More than contracted hours but less than Full-time hours: Regular hourly basic rate

Exceeding Full-time hours: 1.5x the hourly rate

3. Paid Public Holidays

Part-timers are entitled to paid public holidays (PH), where payment for the day is pro-rated based on the number of hours you work.

How to calculate paid public holidays:

(Part-time working hours per year / Full-time working hours per year) x PH days for a Full-timer with equal length of service x Working hours in a day for Full-timer

Example

Part-time: 20 hours /week

Full-time: 40 hours week (8 hours /day)

1 year: 52 weeks

PH: 11 days /year

((20×52) / (40×52)) x 11 x 8 = 44 hours of pay for 11 public holidays

44 hours / 11 = Part-timer is entitled to 4 hours of pay per public holiday

4. Rest Days

Are you a Part-timer covered under the Part 4 of the Employment Act? If so, this section is for you.

If the part-timer is required to work at least 5 days a week, they are entitled to 1 rest day per week. The rest day will be determined by the employer beforehand.

However, if a part-timer is required to work on a rest day, their pay will depend on:

Employers’ request:

Up to half their regular work hours: 1 day’s salary at basic hourly rate

More than half their regular work hours: 2 day’s salary at basic hourly rate

More than their regular work hours, up to FT work hours: 2 day’s salary + basic hourly rate

More than FT work hours: 2 day’s salary + basic hourly rate + 1.5x basic hourly rate

Employee’s request:

Up to half their regular work hours: 0.5 day’s salary at basic hourly rate

More than half their regular work hours: 1 day’s salary at basic hourly rate

More than their regular work hours, up to FT work hours: 1 day’s salary + basic hourly rate

More than FT work hours: 1 day’s salary + basic hourly rate + 1.5x basic hourly rate

5. CPF contributions

Just like full-timers, part-timers are entitled to CPF contributions from their employers.

CPF contributions are payable if the Part-timer is:

- Singapore Citizen/ Permanent Resident

- Earning more than $50 /month

- Engaged under a contract of service (employer-employee relationship)

Flexibility Without Compromising Rights

Part-time employment in Singapore offers a perfect balance between flexible working arrangements and safeguarding employee rights. Whether you are balancing family responsibilities, furthering your education, or pursuing personal passions, Part-time work provides the adaptability you need without sacrificing benefits or security.

We hope this guide has shed some light on your rights as a Part-time employee and inspires confidence in exploring this flexible career option. For any enquiries on employment contract disputes or drafting, engage our seasoned professionals for legal assistance.

Disclaimer: The content of this article does not constitute legal advice and should not be relied on as such. Specific legal advice should be sought for your circumstances.

Estate Matters and Distribution of Assets — Part 4

Welcome back to the last installment of our four-part series!

In this section, we will share more about applying for the Resealing of a Foreign Grant, helping you understand what it is and how it works.

In Singapore, Foreign Grants issued by Commonwealth Countries and Hong Kong may be resealed by the Family Division of the High Court.

Essentially, this means that the Foreign Grant is recognised and given legal recognition by the Singapore Courts.

Upon resealing, the powers provided for in the Foreign Grant may be carried out in Singapore, with no alteration to its terms, as if it were a grant issued in Singapore.

Documents Required for the Application

When applying for a resealing of foreign grant, it is important to note that only Foreign Grants of Probate / Letters of Administration issued by Commonwealth Countries and/or Hong Kong are eligible for the resealing process.

For other countries, a fresh Grant of Probate or Letters of Administration application is required.

The Executors / administrators must file several documents through the Singapore Court’s eLitigation system:

- Originating Summons

- Statement

- Court Certified True Copy of Will or Original Will

- Original Death Certificate or Electronically verifiable Death

- Certificate

- Schedule of Assets

- Supporting Affidavit

- Administration Oath

- Administration Bond (if directed)

- Summons for Dispensation of Sureties (if sureties are required but not found)

- Consent of Dispensation of Sureties (if sureties are required but not found)

- Affidavit of Foreign Law (if directed)

Timeframe for Obtaining the Resealed Foreign Grant

The process typically takes at least 3 months from the time of application. However, this timeline can vary depending on the complexity of the case and the completeness of submitted documents.

On approval, the Singapore Courts will issue a Memorandum of Resealing and Notice of Resealing of Grant.

Why the Resealing Process is Important

The Resealing process ensures that the executor / administrator can legally manage the estate as approved in accordance with the Foreign Grant. Without it, financial institutions and other asset holders will not release the deceased’s assets. Additionally, the Resealed Grant of Foreign Probate serves to protect the executor and/or administrator from future legal challenges concerning the administration of the estate.

Distribution of Assets

Distribution of assets depends on whether the original foreign grant was a grant of probate or a letters of administration process:

- If the process was a grant of probate process, assets are distributed in accordance with the Will

- If the process was a letters of administration process, assets are distributed in accordance with the laws of the country of domicile. An affidavit of foreign law may be required to determine the distribution requirements.

Common Challenges in the Resealing of Foreign Grant Process

Executors / Administrators may face challenges, such as when there are:

- Missing documents which are foreign documents.

- Translation of foreign language documents to English.

- Production of an original or certified document requested by the Probate Registry

- Disputes among beneficiaries about the distribution of assets.

- The need for an administration bond or sureties when required by the court, which can delay the process if not promptly addressed.

- Providing an Affidavit of Foreign Law.

Common Challenges in the Resealing of Foreign Grant Process

Executors / Administrators may face challenges, such as when there are:

- Missing documents which are foreign documents.

- Translation of foreign language documents to English.

- Production of an original or certified document requested by the Probate Registry

- Disputes among beneficiaries about the distribution of assets.

- The need for an administration bond or sureties when required by the court, which can delay the process if not promptly addressed.

- Providing an Affidavit of Foreign Law.

Obtaining a Resealed Foreign Grant of Probate is a crucial step in managing a deceased person’s assets. Though it may seem daunting, having the right information and documentation can streamline the process.

Our experienced legal professionals regularly handle resealing applications and are here to guide you through every step and concern. Reach out to us if you are involved in the process or need more information on how to navigate it.

Disclaimer: The content of this article does not constitute legal advice and should not be relied on as such. Specific legal advice should be sought for your circumstances.

Estate Matters and Distribution of Assets — Part 3

Welcome back to the third installment of our four-part series!

In this section, we will share more about applying for Letters of Administration, helping you understand what it is and how it works.

In Singapore, when someone passes on and does not have a will, the next-of-kin may apply for a Letters of Administration from the Singapore courts in accordance with Section 18 of the Probate and Administration Act. This legal document gives the administrator the authority to manage the deceased’s estate, pay off any debts, and distribute the assets as outlined under the Intestate Succession Act 1967.

Which Court Handles the Application?

The application process depends on the value of the deceased’s estate:

- Estates valued up to SGD 5 million are heard by the Family Courts.

- Estates valued over SGD 5 million are heard by the Family Division of the High Court.

Documents Required for the Application

Prior to applying for a Letters of Administration, renunciations must be obtained from all beneficiaries with prior rights. The Intestate Succession Act 1967 specifies seven classes of people who are eligible to apply for this grant, in declining order of priority:

- Spouse;

- Children;

- Parents;

- Siblings;

- Nephews and nieces;

- Grandparents; and

- Aunts and uncles

For example, if a Parent is to apply for a Letters of Administration, renunciations must be obtained from the surviving spouse and children.

Once the renunciation(s) are obtained the applicant / administrator must file several documents through the Singapore Court’s eLitigation system:

- Originating Summons

- Statement

- Renunciations of Beneficiaries with Prior Rights (if necessary)

- Death Certificate

- Schedule of Assets

- Supporting Affidavit

- Administration Oath

- Administration Bond (if directed)

- Summons for Dispensation of Sureties (if sureties are required but not found)

- Consent of Dispensation of Sureties (if sureties are required but not found)

Timeframe for Obtaining the Letters of Administration

The process typically takes about 3 months from the time of application. However, this timeline can vary depending on the complexity of the case and the completeness of submitted documents.

Why the Letters of Administration is Important

The Letters of Administration ensures that the administrator can legally manage the estate according to the will. Without it, financial institutions and other asset holders will not release the deceased’s assets, and the estate cannot be distributed as directed under the Intestate Succession Act 1967. Additionally, a Letters of Administration protects the administrator from future legal challenges concerning the administration of the estate.

Distribution of Assets

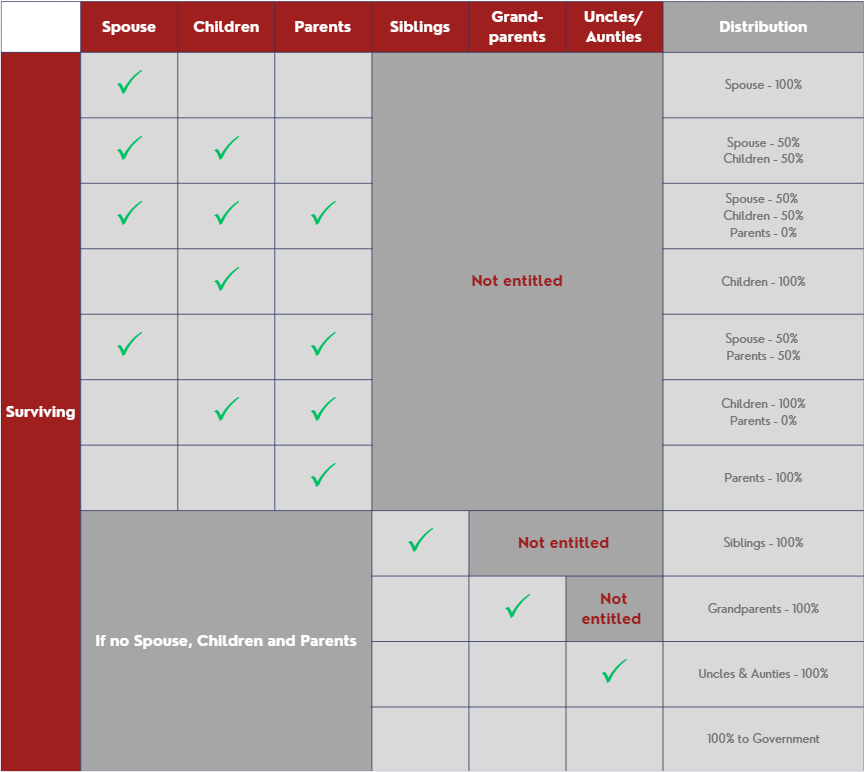

Once the Letters of Administration is issued, assets are distributed in accordance with the Section 7 of the Intestate Succession Act 1967

*Above scenarios are non-exhaustive, please contact LP Law for more information.

Common Challenges in the Letters of Administration Process

Administrators may face challenges, such as when there are:

- Missing documents or where there is difficulty in obtaining renunciations.

- Disputes among beneficiaries about the distribution of assets.

- The need for an administration bond or sureties when required by the court, which can delay the process if not promptly addressed.

Obtaining a Letters of Administration is a crucial step in managing a deceased person’s assets. Though it may seem daunting, having the right information and documentation can streamline the process.

Our experienced legal professionals are here to guide you through every step and concern. Reach out to us if you are involved in a probate process or need more information on how to navigate it.

Disclaimer: The content of this article does not constitute legal advice and should not be relied on as such. Specific legal advice should be sought for your circumstances.

Estate Matters and Distribution of Assets — Part 2

Welcome back to the second installment of our four-part series!

In this section, we will share more about Grant of Probate, helping you understand what it is and how it works.

In Singapore, when someone passes on and leaves behind a will and significant assets, the appointed executor must apply for a Grant of Probate from the Singapore courts. This legal document gives the executor the authority to manage the deceased’s estate, pay off any debts, and distribute the assets as outlined in the Will.

Which Court Handles the Application?

The application process depends on the value of the deceased’s estate:

- Estates valued up to SGD 5 million are heard by the Family Courts.

- Estates valued over SGD 5 million are heard by the Family Division of the High Court.

Documents Required for the Application

To apply for a Grant of Probate, the executor must file several documents through the Singapore Court’s eLitigation system:

- Originating Summons

- Statement

- Original Will (for Probate Registry’s inspection)

- Death Certificate

- Schedule of Assets

- Supporting Affidavit

- Administration Oath

- Administration Bond (where directed by Court)

- Summons for Dispensation of Sureties (if sureties are required but not found)

- Consent of Dispensation of Sureties (if sureties are required but not found)

Timeframe for Obtaining the Grant of Probate

The process typically takes about 3 months from the time of application or more. This timeline can vary depending on the complexity of the case and the completeness of submitted documents.

Why the Grant of Probate is Important

The Grant of Probate ensures that the executor can legally manage the estate according to the will. Without it, financial institutions and other asset holders will not release the deceased’s assets to the executor, and the estate cannot be distributed as intended. Additionally, a Grant of Probate protects the executor from future legal challenges concerning the administration of the estate.

Common Challenges in the Grant of Probate Process

Executors may face challenges, such as when there are:

- Missing documents or an invalid will.

- Disputes among beneficiaries about the validity of the will or the distribution of assets.

- The need for an administration bond or sureties when required by the court, which can delay the process if not promptly addressed.

Obtaining a Grant of Probate is a crucial step in managing a deceased person’s assets. While the process may seem daunting, having the right information and documentation can streamline the process.

Our experienced legal professionals are here to guide you through every step and concern. Reach out to us if you require more information with the probate process and need our professional legal assistance on how to navigate the application.

Disclaimer: The content of this article does not constitute legal advice and should not be relied on as such. Specific legal advice should be sought for your circumstances.