Adoption in Singapore is governed by a clear legal framework under the Adoption of Children Act (ACA), and processed through the Family Justice Courts. While the standard process is well-defined, some adoptions fall under special categories with unique requirements and procedures.

Special Adoption Cases in Singapore: What You Need to Know

Basic Eligibility for Adoption in Singapore

To adopt a child in Singapore, you must:

- Be at least 25 years old

- Be at least 21 years older than the child you wish to adopt

- Be a Singapore Citizen or Permanent Resident (at least one applicant in a joint application must meet this requirement)

Types of Special Adoption Cases

1. Adoption of a Biological Child

This type of adoption arises typically when a child is born out of wedlock (i.e., is considered illegitimate), and the biological mother wishes to legitimise the child under the law. For reasons such as inheritance rights or nationality status.

How it works:

- The biological mother typically applies as a sole applicant.

- Consent should generally be obtained from the biological father, even if his name does not appear on the child’s birth certificate.

2. Adoption of a Stepchild

This scenario occurs when an individual is married to someone who already has a child from a previous relationship and wishes to legally recognise that child as their own.

How it works:

- The stepparent usually applies as a sole applicant.

- Consent from the biological parent (if still alive and retaining parental rights) is required.

3. Adoption of a Niece or Nephew

This applies when an individual seeks to adopt their sibling’s child.

Common reasons include the death, incapacity, or inability of the biological parents to care for the child.

How it works:

- The application can be made either individually or jointly with a spouse.

- Consent from the biological parents is generally required.

4. Adoption of an Unrelated Child (Private Adoption)

This type of adoption involves a child who is not biologically related to the adoptive party and not under state care.

For example, a friend’s child or through a private arrangement.

How it works:

- Applicants may apply either as a sole or joint applicant.

- They should attend mandatory pre-adoption briefings and undergo a home study assessment.

- Consent from the biological parents is typically necessary.

5. Adoption of a Child in State Care

This case involves adopting a child who is under the care of the state or the Ministry of Social and Family Development (MSF), usually due to abandonment, neglect, or the death of the biological parents.

How it works:

- Applicants can apply alone or jointly.

- A comprehensive home study is conducted by an MSF-appointed agency.

- The adoption process is usually facilitated through the Ministry or authorised agencies.

6. Adoption of a Foreign Child

This applies to individuals who wish to adopt a child from overseas who is neither a Singapore citizen nor a permanent resident.

How it works:

- A Home Study Report (HSR) is mandatory, even if the adoption involves a relative.

- Applicants must comply with Singapore’s adoption laws as well as the legal requirements of the child’s home country.

- In most cases, the process involves coordination with the Immigration and Checkpoints Authority (ICA) and MSF.

- To bring the child into Singapore before adoption, a Dependant’s Pass or other relevant visa is required.

How To Get Started

Adoption in Singapore is a legal process overseen by the courts, and each application is evaluated on a case-by-case basis. The welfare and best interests of the child remain the paramount concern.

For the best chances and to ensure compliance, all prospective adoptive parents should consult with family lawyers for holistic guidance and support.

Navigating Divorce in Singapore: A Simplified Guide

Divorce is both an emotional and significant life event, often accompanied with many legal complexities. This article provides a simplified guide on how to get a divorce in Singapore. First, let us take a look at what makes someone eligible for divorce.

Eligibility Criteria for Divorce

Certain conditions must be met to apply to divorce.

Your or your spouse must:

- Have resided in Singapore for at least three years

- Have been married for at least three years. However, with permission, exceptions can be granted in cases of exceptional hardship or depravity.

If you are married under Syariah Law, you must file for divorce in the Syariah Court.

Grounds for Divorce

To be granted a divorce in Singapore, you will have to show irretrievable breakdown of your marriage. This can be established through one of the following:

1. Adultery: Your spouse has cheated on you, and you find it intolerable to continue living together.

2. Unreasonable Behaviour: Your spouse has behaved in a way that makes it unreasonable for you to live together. This includes abuse (physical or mental) or other forms of misconduct.

3. Desertion: Your spouse has deserted you for at least two years with no intention of returning.

4. Separation:

- With Consent: Both parties have lived apart for at least three years and agree to the divorce.

- Without Consent: Both parties have lived apart for at least four years.

5. Mutual Agreement: Both parties agree that their marriage has irretrievably broken down. This requires a written agreement stating the reasons for the breakup, efforts made to reconcile and a few other considerations.

Contested vs Uncontested Divorce

Will the divorce proceedings be contested by a party?

If both parties are agreeable to the divorce, parties may apply for uncontested divorce proceedings under the simplified track. Essentially this just means that the divorce process is faster and more straightforward compared to the normal track.

If a party contests to any part of the divorce, the divorce proceedings will have to be completed on the normal track.

Divorce is a 2-stage process:

1. Dissolution of Marriage:

- Filing for Divorce: Start out the process by submitting the necessary legal documents via the eLitigation platform. It is recommended to consult a lawyer to assist in preparing these documents.

- Serving of Documents: The Originating Application must be served to your spouse within 14 days of filing (in Singapore) or 28 days of filing (overseas).

- Interim Judgment: If the court is satisfied that the marriage has irretrievably broken down, it will issue an Interim Judgment while ancillary matters are being resolved.

2. Ancillary Matters:

The second stage of a contested divorce process deals with all other ancillary matters including the division of matrimonial assets, maintenance of spouse and child(ren), as well as access, care and custody of the child(ren).

- Child Care Arrangements: If you and your spouse have children, arrangements such as custody, care and access will have to be discussed prior to the divorce. These affect major decisions for the child, which parent they live with, how often each parent gets to see the child, and more.

- Asset Distribution: You and your spouse will have to decide on how assets such as your matrimonial house and joint bank account monies will be divided.

- Maintenance: Financial support such as alimony and child support will have to be assessed and discussed.

Divorce is a life-changing event that can take a toll emotionally and financially. Allow us to figure out the complexities of these proceedings while you focus on the emotional aspects of the process. Reach out to our professionals today for any questions or assistance on divorce in Singapore.

Disclaimer: The content of this article does not constitute legal advice and should not be relied on as such. Specific legal advice should be sought for your circumstances.

Estate Matters and Distribution of Assets — Part 4

Welcome back to the last installment of our four-part series!

In this section, we will share more about applying for the Resealing of a Foreign Grant, helping you understand what it is and how it works.

In Singapore, Foreign Grants issued by Commonwealth Countries and Hong Kong may be resealed by the Family Division of the High Court.

Essentially, this means that the Foreign Grant is recognised and given legal recognition by the Singapore Courts.

Upon resealing, the powers provided for in the Foreign Grant may be carried out in Singapore, with no alteration to its terms, as if it were a grant issued in Singapore.

Documents Required for the Application

When applying for a resealing of foreign grant, it is important to note that only Foreign Grants of Probate / Letters of Administration issued by Commonwealth Countries and/or Hong Kong are eligible for the resealing process.

For other countries, a fresh Grant of Probate or Letters of Administration application is required.

The Executors / administrators must file several documents through the Singapore Court’s eLitigation system:

- Originating Summons

- Statement

- Court Certified True Copy of Will or Original Will

- Original Death Certificate or Electronically verifiable Death

- Certificate

- Schedule of Assets

- Supporting Affidavit

- Administration Oath

- Administration Bond (if directed)

- Summons for Dispensation of Sureties (if sureties are required but not found)

- Consent of Dispensation of Sureties (if sureties are required but not found)

- Affidavit of Foreign Law (if directed)

Timeframe for Obtaining the Resealed Foreign Grant

The process typically takes at least 3 months from the time of application. However, this timeline can vary depending on the complexity of the case and the completeness of submitted documents.

On approval, the Singapore Courts will issue a Memorandum of Resealing and Notice of Resealing of Grant.

Why the Resealing Process is Important

The Resealing process ensures that the executor / administrator can legally manage the estate as approved in accordance with the Foreign Grant. Without it, financial institutions and other asset holders will not release the deceased’s assets. Additionally, the Resealed Grant of Foreign Probate serves to protect the executor and/or administrator from future legal challenges concerning the administration of the estate.

Distribution of Assets

Distribution of assets depends on whether the original foreign grant was a grant of probate or a letters of administration process:

- If the process was a grant of probate process, assets are distributed in accordance with the Will

- If the process was a letters of administration process, assets are distributed in accordance with the laws of the country of domicile. An affidavit of foreign law may be required to determine the distribution requirements.

Common Challenges in the Resealing of Foreign Grant Process

Executors / Administrators may face challenges, such as when there are:

- Missing documents which are foreign documents.

- Translation of foreign language documents to English.

- Production of an original or certified document requested by the Probate Registry

- Disputes among beneficiaries about the distribution of assets.

- The need for an administration bond or sureties when required by the court, which can delay the process if not promptly addressed.

- Providing an Affidavit of Foreign Law.

Obtaining a Resealed Foreign Grant of Probate is a crucial step in managing a deceased person’s assets. Though it may seem daunting, having the right information and documentation can streamline the process.

Our experienced legal professionals regularly handle resealing applications and are here to guide you through every step and concern. Reach out to us if you are involved in the process or need more information on how to navigate it.

Disclaimer: The content of this article does not constitute legal advice and should not be relied on as such. Specific legal advice should be sought for your circumstances.

Estate Matters and Distribution of Assets — Part 3

Welcome back to the third installment of our four-part series!

In this section, we will share more about applying for Letters of Administration, helping you understand what it is and how it works.

In Singapore, when someone passes on and does not have a will, the next-of-kin may apply for a Letters of Administration from the Singapore courts in accordance with Section 18 of the Probate and Administration Act. This legal document gives the administrator the authority to manage the deceased’s estate, pay off any debts, and distribute the assets as outlined under the Intestate Succession Act 1967.

Which Court Handles the Application?

The application process depends on the value of the deceased’s estate:

- Estates valued up to SGD 5 million are heard by the Family Courts.

- Estates valued over SGD 5 million are heard by the Family Division of the High Court.

Documents Required for the Application

Prior to applying for a Letters of Administration, renunciations must be obtained from all beneficiaries with prior rights. The Intestate Succession Act 1967 specifies seven classes of people who are eligible to apply for this grant, in declining order of priority:

- Spouse;

- Children;

- Parents;

- Siblings;

- Nephews and nieces;

- Grandparents; and

- Aunts and uncles

For example, if a Parent is to apply for a Letters of Administration, renunciations must be obtained from the surviving spouse and children.

Once the renunciation(s) are obtained the applicant / administrator must file several documents through the Singapore Court’s eLitigation system:

- Originating Summons

- Statement

- Renunciations of Beneficiaries with Prior Rights (if necessary)

- Death Certificate

- Schedule of Assets

- Supporting Affidavit

- Administration Oath

- Administration Bond (if directed)

- Summons for Dispensation of Sureties (if sureties are required but not found)

- Consent of Dispensation of Sureties (if sureties are required but not found)

Timeframe for Obtaining the Letters of Administration

The process typically takes about 3 months from the time of application. However, this timeline can vary depending on the complexity of the case and the completeness of submitted documents.

Why the Letters of Administration is Important

The Letters of Administration ensures that the administrator can legally manage the estate according to the will. Without it, financial institutions and other asset holders will not release the deceased’s assets, and the estate cannot be distributed as directed under the Intestate Succession Act 1967. Additionally, a Letters of Administration protects the administrator from future legal challenges concerning the administration of the estate.

Distribution of Assets

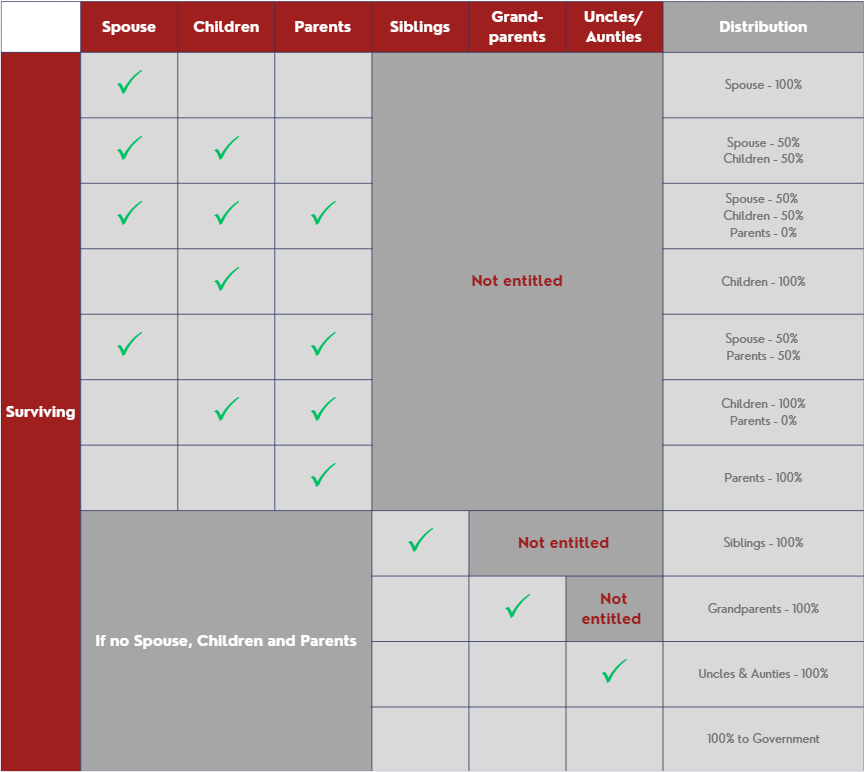

Once the Letters of Administration is issued, assets are distributed in accordance with the Section 7 of the Intestate Succession Act 1967

*Above scenarios are non-exhaustive, please contact LP Law for more information.

Common Challenges in the Letters of Administration Process

Administrators may face challenges, such as when there are:

- Missing documents or where there is difficulty in obtaining renunciations.

- Disputes among beneficiaries about the distribution of assets.

- The need for an administration bond or sureties when required by the court, which can delay the process if not promptly addressed.

Obtaining a Letters of Administration is a crucial step in managing a deceased person’s assets. Though it may seem daunting, having the right information and documentation can streamline the process.

Our experienced legal professionals are here to guide you through every step and concern. Reach out to us if you are involved in a probate process or need more information on how to navigate it.

Disclaimer: The content of this article does not constitute legal advice and should not be relied on as such. Specific legal advice should be sought for your circumstances.

Estate Matters and Distribution of Assets — Part 2

Welcome back to the second installment of our four-part series!

In this section, we will share more about Grant of Probate, helping you understand what it is and how it works.

In Singapore, when someone passes on and leaves behind a will and significant assets, the appointed executor must apply for a Grant of Probate from the Singapore courts. This legal document gives the executor the authority to manage the deceased’s estate, pay off any debts, and distribute the assets as outlined in the Will.

Which Court Handles the Application?

The application process depends on the value of the deceased’s estate:

- Estates valued up to SGD 5 million are heard by the Family Courts.

- Estates valued over SGD 5 million are heard by the Family Division of the High Court.

Documents Required for the Application

To apply for a Grant of Probate, the executor must file several documents through the Singapore Court’s eLitigation system:

- Originating Summons

- Statement

- Original Will (for Probate Registry’s inspection)

- Death Certificate

- Schedule of Assets

- Supporting Affidavit

- Administration Oath

- Administration Bond (where directed by Court)

- Summons for Dispensation of Sureties (if sureties are required but not found)

- Consent of Dispensation of Sureties (if sureties are required but not found)

Timeframe for Obtaining the Grant of Probate

The process typically takes about 3 months from the time of application or more. This timeline can vary depending on the complexity of the case and the completeness of submitted documents.

Why the Grant of Probate is Important

The Grant of Probate ensures that the executor can legally manage the estate according to the will. Without it, financial institutions and other asset holders will not release the deceased’s assets to the executor, and the estate cannot be distributed as intended. Additionally, a Grant of Probate protects the executor from future legal challenges concerning the administration of the estate.

Common Challenges in the Grant of Probate Process

Executors may face challenges, such as when there are:

- Missing documents or an invalid will.

- Disputes among beneficiaries about the validity of the will or the distribution of assets.

- The need for an administration bond or sureties when required by the court, which can delay the process if not promptly addressed.

Obtaining a Grant of Probate is a crucial step in managing a deceased person’s assets. While the process may seem daunting, having the right information and documentation can streamline the process.

Our experienced legal professionals are here to guide you through every step and concern. Reach out to us if you require more information with the probate process and need our professional legal assistance on how to navigate the application.

Disclaimer: The content of this article does not constitute legal advice and should not be relied on as such. Specific legal advice should be sought for your circumstances.

Estate Matters and Distribution of Assets — Part 1

This is the first part of our four-part series, where we will introduce you to Grants of Representation, including Grant of Probate, Letters of Administration, and the Resealing of a Foreign Grant.

GRANTS OF REPRESENTATION

A Will informs your beneficiaries your wishes for the distribution of your assets.

However, in most cases, your executors or administrators will still need a Grant of Representation to distribute the assets.

In Singapore, the different types of Grants of Representation are:

- Grant of Probate – where there is a Will

- Letters of Administration – where there is no Will

- Resealing of a Foreign Grant – where a Grant has been issued by a Commonwealth country (example, Malaysia)

Estate Bank Account

Upon obtaining a Grant of Representation, the executors or administrators will be required to open an estate banking account for the funds to be transferred into.

This also helps to ensure that the funds are properly accounted for and distributed.

These processes will be further discussed in our subsequent posts.

OTHER ASSET DISTRIBUTIONS

Approaching the Public Trustee

Other than the above Grants of Representation, the Public Trustee also has the discretion to administer the estates of deceased persons, where the value of the estate does not exceed $50,000.

Typically, beneficiaries may want to approach the Public Trustee where the assets are not major, and the distribution is not complicated.

Central Provident Fund (CPF)

Not all assets may be dealt with via a Will and/or Grant of Representation.

The Public Trustee is the exclusive administrator of the CPF belonging to deceased persons.

Distribution of CPF will go according to either, (1) nomination, if there is a nomination, or (2) the Intestate Succession Act (Cap. 146).

Even if there are provisions in a Will that deals with CPF, such provisions will not take effect.

The Public Trustee also holds on trust CPF for minor beneficiaries who are below 18 years of age for nominated beneficiaries, and 21 years of age for unnominated beneficiaries.

Insurance

Insurance proceeds are generally dealt with via a revocable or non-revocable nomination with the insurance company. This is typically the fastest and easiest method to obtain insurance payouts.

Distribution clauses in a valid Will pertaining to insurance proceeds will take effect in the event a nomination was not made.

Stay tuned for the next few parts of this series, where we dive deeper into each topic on the Grant of Probate, Letters of Administration and Resealing of a foreign grant. Don’t miss out on the valuable insights and practical tips coming your way.

Be sure to check back soon!

Disclaimer: The content of this article does not constitute legal advice and should not be relied on as such. Specific legal advice should be sought for your circumstances.

Deed Polls – Changing your name in Singapore

A deed poll is a legal document that states your current name and the new name that you would like to be referred as.

Procedure

- A lawyer will draft the change of name deed poll. You will need to arrange for a meeting at the law firm for signing of the deed poll.

- You will need to bring your identification documents along to the law firm.

- You will sign the change of name deed poll before witnessing lawyer who will then paste red sticker seals against your signature to signify that it is signed as a deed.

Choosing a new name

There are no requirements when choosing a new name, however, the ICA may reject certain names which are considered offensive or vulgar.

Parental Consent

Parental consent for change of name is necessary for minors below 21 years old and parents will need to attend at the law firm together with the minor for signing of the deed poll.

After Signing the Deed Poll

You should inform your change of name to important organizations such as:

- The ICA to replace your NRIC and Passport

- Your banks and insurance companies

Disclaimer: The content of this article does not constitute legal advice and should not be relied on as such. Specific legal advice should be sought for your circumstances.